A Beginners Guide to Investing in Bitcoin Mining

By Spencer Sherwood Ever since Bitcoin mining was banned in China during 2021, investors have been taking advantage of the opportunity and pouring money into mining operations elsewhere in...

Much like traders and investors speculating on future Bitcoin prices, those in the Bitcoin mining industry must also make large wagers on the value of ASIC mining hardware over time. For example, one may bet that if BTC prices continue to grow at historical rates in 2022 (about 180%/year), which given the current macro climate is not considered to be all that unlikely, then we might expect the climb in BTC price to translate into a short-term appreciation in ASIC values. But then again, the mining hardware market is not quite as straightforward as this example.

In order to operate a successful Bitcoin mining business long-term, it’s vital to understand how and why certain factors can influence the mining rig market in order to plan for various scenarios in your mining profitability analysis. Changes in semiconductor chip manufacturing and distribution, mining difficulty, and BTC price all have specific effects on the price of mining hardware. In this article, we’ll discuss why we think the average cost of building out a Bitcoin mining rig could increase due to ASIC prices finding new highs in 2022.

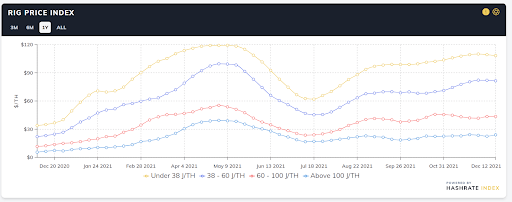

Before we get started, let’s take a look at the prices of various ASICs over the course of this last year using the Rig Price Index from Hashrate Index. Keep in mind, higher prices are for more efficient rigs.

During the summer, we saw a significant drop in ASIC pricing. The drop came after a sizable BTC price crash and China’s ban on Bitcoin mining, which required Chinese miners to either relocate or shut down their operations. From the miners that had to liquidate their operations, we saw a significant but short-lived increase in the supply of ASICs on the market. But at the same time, there was also a slight decrease in demand for mining hardware because BTC price had dropped (more on this later).

Since then, the mining rig market has not seen any significant price drops despite BTC price falling significantly. This is most likely due to Bitcoin miners’ efforts to try to scale up their operations right now, demonstrating that not many miners are still profitable at the current price levels. Scaling up, however, may prove to be a challenge at the moment.

Perhaps the first thing to consider with mining rig prices is the all important semiconductor chip that is responsible for the hashing (i.e. the computing) in ASIC machines. These chips are a vital piece to most electronics as they regulate the flow of electrical current. Not only do Bitcoin mining machines rely upon them, but so do cellphones, TVs, cars, and much more. Thus, the availability (or lack thereof) for semiconductor chips is a key factor influencing the potential supply of new ASICs coming online.

Every mining hardware manufacturer, even popular ones such as Bitmain and MicroBT, must compete with large companies across other industries. Companies like Apple and Toyota are dominant players that enjoy a large capacity of chip manufacturing output from TSMC and Samsung.

To make acquiring chips more difficult, the world is seeing supply chain issues pile up in every major industry. Since one of the most important global industries affected happens to be semiconductor chips, we’re going to see a lower production of Bitcoin machines.

These supply chain issues drive more intense competition to buy ASICs, but they also have an interesting effect on mining difficulty. As there are more significant limits to the amount of ASICs that can be produced, less new mining hardware can enter the mining world. This means difficulty can only grow as fast as MicroBT M30s, Antminer S19s, or any other Bitcoin mining machine can be produced.

Another piece of the puzzle that Bitcoin miners need to be aware of is the network difficulty. In our profitability comparisons between the Antminer S19 Pro and the Antminer S19 XP, we discussed why we believe network difficulty is only going to increase as North American mining scales up and the rest of the Chinese miners finish relocating. Difficulty is important since it directly influences how profitable a mining rig can be.

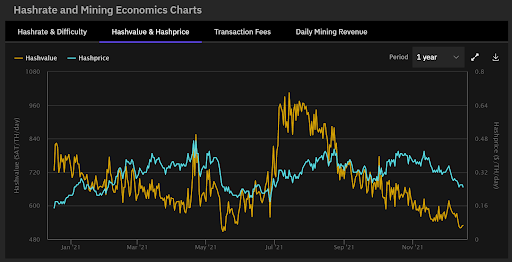

For Bitcoin mining ASICs, an increase in network difficulty results in a decrease in hashvalue. Hashvalue measures the amount of revenue generated by one terahash of hashrate, in BTC terms (Hashvalue = BTC/TH/day).

A great example of the importance of hashvalue can be seen in the chart above. Starting July of 2021, we saw a major decrease in difficulty when China banned Bitcoin mining. The Chinese mining industry was responsible for roughly 50% of the hashrate at the time of the ban, and the result was a major pump in hashvalue (as seen on the chart).

Now as more miners continue to enter the game and existing players scale, difficulty will continue to ramp up, and everyone’s slices of hashrate pie will slim down. So, in order to maintain steady BTC production from Bitcoin mining rigs, miners must increase their operational hashrate proportionally to the increase in total network hashrate. In other words, they need to maintain their market share as difficulty increases. We can expect that the demand for Bitcoin mining machines will grow as everyone competes to increase their hashrate. Demand that can’t be met by new machines due to limited manufacturing capacity will then result in higher ASIC prices on the secondary market.

Hashvalue expresses how much opportunity there is to mine. And although difficulty is important to Bitcoin miners, it is not necessarily the ultimate indicator of mining hardware price.

Closely related to and dependent on hashvalue is hashprice. Hashprice is revenue generated by one terahash of hashrate in USD terms (Hashprice = $/TH/day). Multiplying hashvalue by BTC price gives you hashprice. ASIC pricing is largely determined by hashprice since it illustrates the value of the total BTC an ASIC can mine at a given difficulty, each day. To further understand this, let’s take a few examples.

First, let’s suppose the network difficulty were to increase 2x from 24T, but the price of BTC were to stay constant at $50K. Since hashvalue is more or less inversely proportional to difficulty (not accounting for transaction fees), Bitcoin miners would see their hashvalue get cut by 50%. Since BTC price has remained constant, the 50% drop in hashvalue ends up slicing our hasprice by 50% as well.

Difficulty | 24T | 48T |

Hashvalue | 1000 SAT/TH/day | 500 SAT/TH/day |

BTC Price | $50K | $50K |

Hashprice | $0.5/TH/day | $0.25/TH/day |

Next, let’s suppose that network difficulty were to increase 2x from 24T while the price of BTC climbed up 4x (as may be expected during a bull run). Even though our mining rigs will suffer a hahvalue drop of 50%, our hashprice is saved by the bull run and we see an increase of 100%.

| Difficulty | 24T | 48T |

| Hashvalue | 1000 SAT/TH/day | 500 SAT/TH/day |

| BTC Price | $50K | $200K |

| Hashprice | $0.5/TH/day | $1.00/TH/day |

Thus, it is important to note that hashprice can move independently from difficulty.

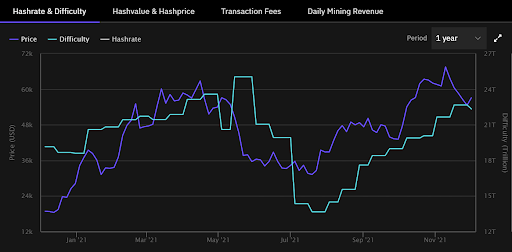

Another example of this can be found in the chart above which shows BTC price and difficulty throughout 2021. You may ask, why didn’t hashprice double when hashvalue doubled in July? Despite the significant decrease in difficulty, the price of BTC also happened to drop by nearly 50% around the same time.

Now that we have a good understanding of some key components that impact ASIC pricing, let’s put it all together. ASIC prices are closely correlated with hashprice. This is because hashprice measures the value of the total Bitcoin an ASIC can mine at a given difficulty, each day. When hashprice goes up, it’s highly probable that ASIC prices will as well. The increase in hashprice means there is either a drop in difficulty, signaling an opportunity to mine more Bitcoin, or an increase in BTC price, making Bitcoin mining more worthwhile, or both.

As for difficulty, it’s only going to increase in the long-term (we anticipate 60-110%/year), but growth will be slow and steady compared to the volatile price action for BTC. This is mostly because factors like supply chain issues in ASIC manufacturing and the difficulty of building large scale mining infrastructure put a cap on the difficulty growth rate. However, as we know, the price of BTC can increase much much faster than 100%/year, especially in bull markets. With an ASIC supply chain bottleneck occurring in the midst of a bull market, hashprice will go up, and so will mining hardware prices.

All of these factors together spell higher ASIC prices in 2022. The good news is if you are bullish on BTC, then you should expect your Bitcoin mining machines to be appreciating assets. Especially when you consider they also generate discounted BTC cash flow since price continues to grow during the bull market.Also, with BTC mining hardware likely to increase in value in 2022, there’s a good case to be made for purchasing ASICs and generating discounted BTC from appreciating mining rigs rather than just buying spot BTC. This of course assumes you have a place to run a Bitcoin mining rig with decent electricity, like, for example, with our Managed Mining Program.

By Spencer Sherwood Ever since Bitcoin mining was banned in China during 2021, investors have been taking advantage of the opportunity and pouring money into mining operations elsewhere in...

Is the Antminer S19 XP Worth It? Part 1 (Mining Profitability Analysis) Introduction In November, 2021, Bitmain announced a new addition to the Antminer S19-series at the World Digital...

By Adan Kohnhorst Oslo Freedom Forum Bitcoin Panels Headlines in major publications are quick to decry Bitcoin over the industry’s perceived environmental impact. But are these concerns well-founded, or...

By Adan Kohnhorst Bitcoin adoption is more widespread than ever before, and that means more people are becoming curious about Bitcoin mining. But in a volatile market, some wonder...

By Daniel Frumpkin The bitcoin mining industry had a year to remember in 2021, with exponential growth in the Western market led by publicly traded mining companies in Canada...

By Adan Kohnhorst Cryptocurrency Cloud Mining vs Colocation Mining Bitcoin has shown that it’s here to stay, and as a result, more people are trying to get started mining...